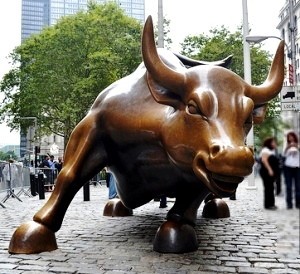

Staring Down the Bear [Market]: Investing Insights in Response to COVID-19

It will forever be remembered as the COVID-19 Crisis of 2020, when the coronavirus pandemic turned an unprecedentedly long bull market into a bear market in the matter of a week.

The COVID-19 (coronavirus) pandemic brought a halt to a period of sustained stock market and economic growth that dates back to the end of the Great Recession. After 11 years, 13% annualized earnings growth and 16% annualized trough-to-peak appreciation, people with investment assets were reintroduced to a phenomenon they hadn’t experienced in more than a decade: a bear market.

As unprecedented as the impact of the pandemic has been on virtually every facet of life, the financial ramifications of the crisis were particularly concerning for people because they could be felt, or at least seen, immediately, as stock markets — and peoples’ investment portfolios and retirement accounts — sustained a series of drops in value.

How to manage your assets amid bear market signals like these? CERTIFIED FINANCIAL PLANNER™ professional members of the Financial Planning Association® (FPA®) offer the following suggestions:

Resist the urge to let emotions dictate how you manage your money and assets. If the Great Recession and the behavior of the equity markets since then have taught us anything, it is that knee-jerk, emotion-fueled investing and financial decisions made in reaction to a bear market can unnecessarily erase years of solid investment performance and decision-making, hamper a person’s ability to meet long-term life goals and undermine their overall financial health.

Rather than making asset-management decisions that ultimately run counter to your best financial interests, think and act strategically, in concert with a financial professional you trust. You may need to take some action with your investments as a result of shifting market conditions; that’s a subject to discuss with a financial planner.

Keep calm, carry on and maintain perspective. Stock market downturns typically don’t last nearly as long as bear markets. According to First Trust Advisors, from 1926 to 2019, the U.S. stock market has experienced eight bear markets (drops of 20% or more in the major market indices) ranging in length from six months to 2.8 years. The average bull market lasted 6.6 years, with an average cumulative total return of 339%. The average bear market lasted 1.3 years with an average cumulative loss of -38%. If history is an accurate guide, we will pull out of the bear market sooner rather than later.

History suggests that equity markets will recover. An analysis by T. Rowe Price found that from 1928 to 2017, stocks grew annually by an average of 10.2 percent. And that factors in the 25 years during which there were negative returns. While rates this robust may not hold true going forward, average growth that’s half that historical rate is still solid.

Ensure your assets are appropriately allocated. A person’s assets should be strategically allocated across various classes: equities (stocks, etc.) and fixed investments (bonds and the like), primarily, along with real estate and, perhaps, alternative investments. Allocating assets appropriately across those classes means finding the right balance between growth potential and downside protection. That balance depends on a person’s risk profile — i.e., their age and stage of life, life goals, financial obligations over the short and long terms, and a range of other individual factors.

Because large swings in investment markets tend to result in shifts within a person’s asset portfolio, it’s wise to assess how those assets are allocated in the wake of a significant stock market drop such as the one precipitated by the COVID-19 pandemic, adjusting as necessary.

Manage your cash reserve wisely. In the context of asset allocation, it’s also important for people to maintain a cash reserve or emergency fund, from which they can draw in a pinch (such as due to a job loss) instead of having to resort to liquidating stocks or tapping retirement accounts when their value is down during a bear market. How large of a cash reserve? The general rule of thumb is three months — but preferably closer to six to nine months — of basic living expenses. Be sure that money is readily accessible in a high-yield savings or money-market account, for example.

Enlist the help of a financial professional to guide you. Despite all the pandemic-related restrictions, many financial professionals are on call and available for virtual meetings and phone conversations to help existing as well as new clients. To find a CERTIFIED FINANCIAL PLANNER™ professional in your area, check out FPA’s searchable national database at www.PlannerSearch.org.

Take advantage of opportunities to dollar-cost-average. One step investors can take to blunt the impact of drops in the value of their retirement accounts, college savings plans and investment portfolios is to continue to invest a fixed amount in those accounts. This maneuver, known as dollar-cost-averaging, essentially enables them to take advantage of a buying opportunity when prices are lower.

Get a big-picture financial plan if you don’t have one, and if you do have one, revisit it. A good long-term financial plan specifies the asset-management strategies and steps you plan to take, if any, during a bear market. If you don’t have a plan in place, enlist a financial planner to create one for you. Ask friends, family and business colleagues/connections for a referral, or search FPA’s database to find one.